FRAME 3: CUSTOMER ACQUISITION COSTS AND THE MACRO MARKET

How can the macro environment make or break customer acquisition costs for startups?

When the economy is good, business and consumer spending increases. As a result, we see increased funding to early stage companies from venture capitalists, angels, and PE firms. Consequently, competition from new entrants floods the market and drives acquisition costs up (all things equal).

When the economy is down, business and consumer spending falls with it. Venture capital also slows, miniaturizing new entrants and overall competition. As companies fail and the rate of new entrants decelerates, the diminished demand for advertising drives acquisition costs down (all things equal).

Back to the same question:

Once again, the same question we grappled with in the previous letters rears its head again: where are we in the macro cycle? Are we in an up market or a down market (as it pertains to acquisition costs)?

Let's look at the refreshed data:

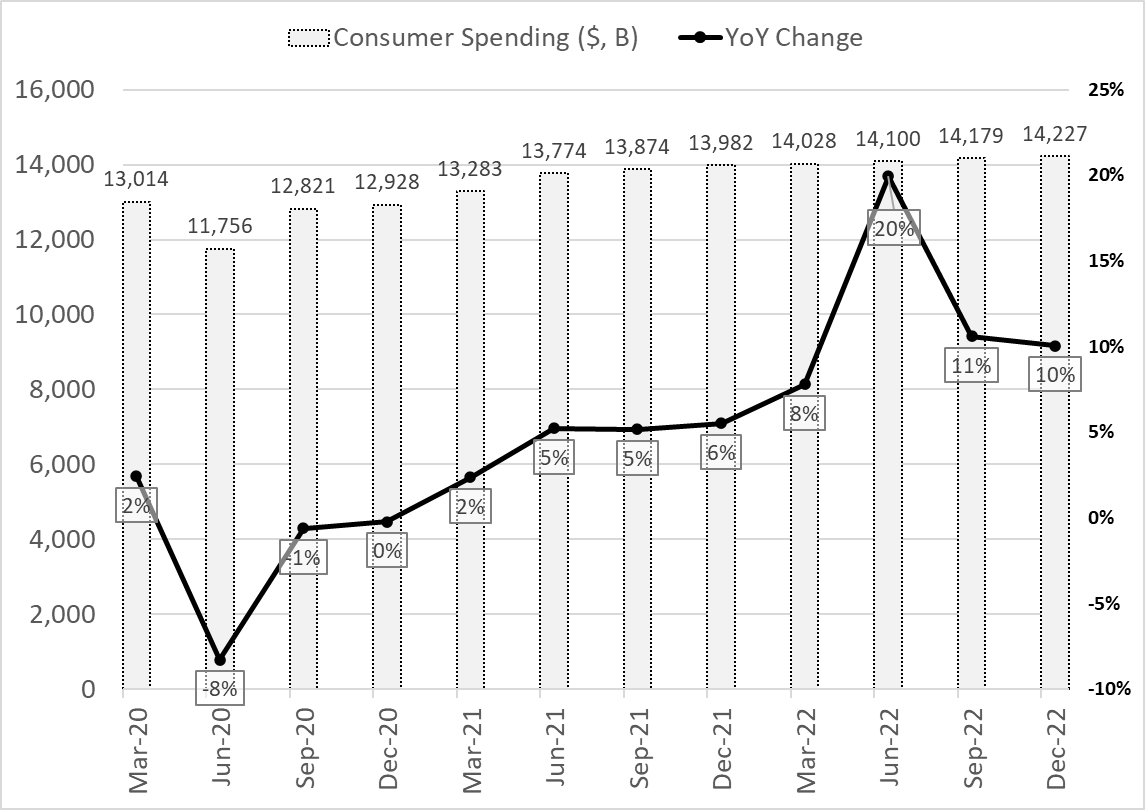

1. Consumer spending has been holding strong, the last reading was up 10% YoY:

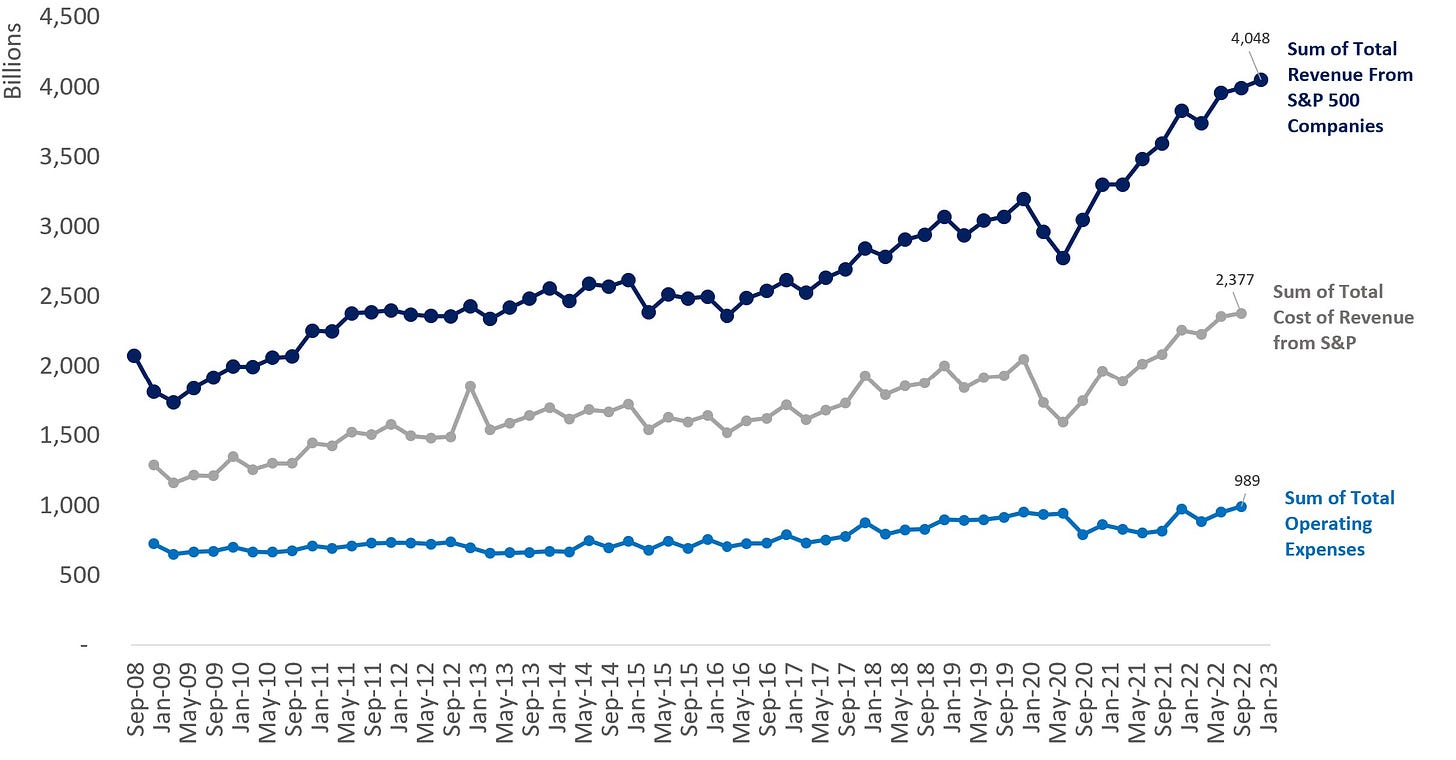

2. Business spending is up ~14% YoY in the US, driven by higher variable costs, not OpEx:

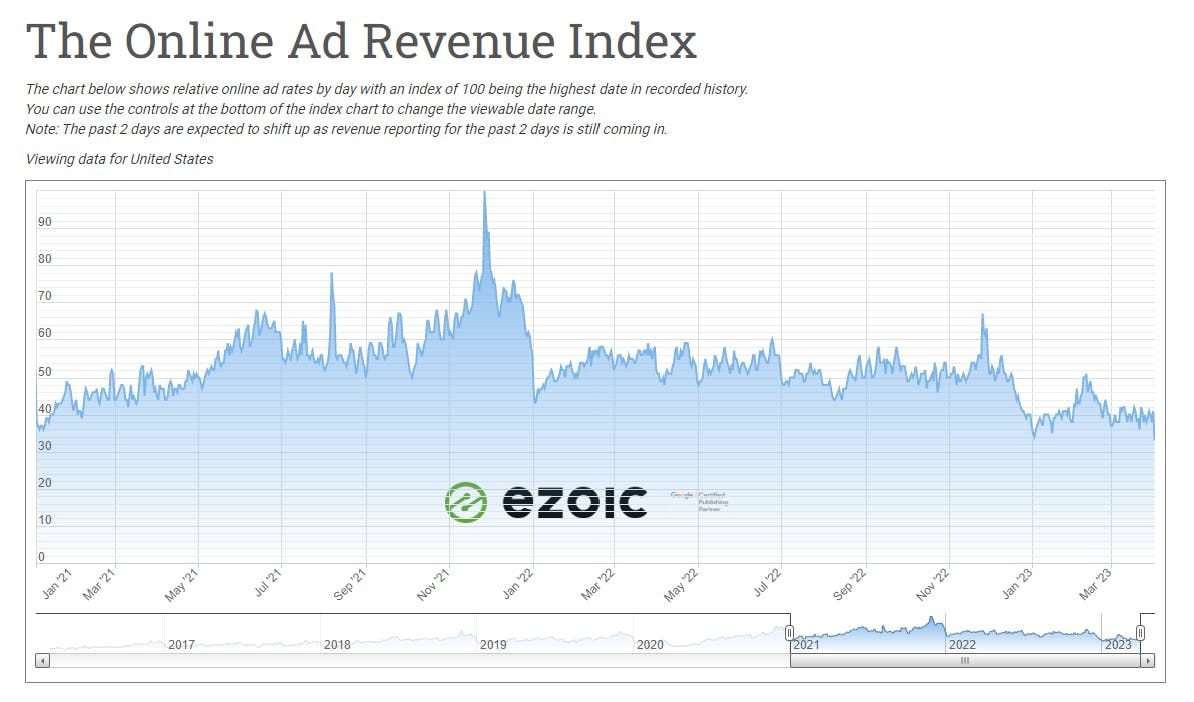

3. Online advertising is getting cheaper on lower demand (result of flat-to-down OpEx):

4. VC funding has dried up over the last year:

You can see this trend mirrored in the sharp decline in exit activity in the US over 2022:

The gap is most noticeable in the end of the SPAC boom of 2020-2021:

One offset to this is that venture capital dry powder continues to trend up and will need to be released at some point:

WHAT IT MEANS FOR YOU:

Data Point: consumer spending is up but marketing budgets have retracted

We're hearing from portfolio companies that they're cutting back on their marketing budgets to preserve runway. There's also some news to suggest larger companies are also being cautious with their marketing budgets. This creates favorable conditions for companies that go against the grain and spend on marketing. Ad dollars will likely go further while consumer spending remains strong.

Data Point: Business spending continues to be strong

For B2B: technology is advancing rapidly. Our aggregate S&P graph above shows this. Look to automate your outbound strategy for B2B in order to capitalize on business spending trends, which remain strong. There is still appetite for investments from businesses in technology and contract labor. There seems to be less appetite for spend on headcount. Conversion rates on professional services and other software vendors should see a tailwind in 2023.

For B2C: it's important to note: even though there has been an overall increase in business spending, the majority of the increase is concentrated in COGS. Operating expenses have been flat to down. Marketing budgets have been slashed. This is good news for B2C companies as we covered in the bullet point above. Bidding for SEO terms and digital marketing efforts have likely scaled back.

Data Point: VC funding drought will suppress new entrants

Exit opportunities (whether that be M&A or IPOs) for later-stage companies have dried up. There's not as much appetite to exit at lower valuations. There is a push for companies to get profitable and extend runway. New entrants into the market will find it hard to raise capital. All things equal, there will be less competition for digital ads from new entrants with large budgets from strong venture funding events.

Data Point: VC dry powder is accumulating and will need to be released soon, which will drive marketing budget expansion

Venture capital dry powder is rising. There's a ton of capital on the sidelines. It will have to be released. We'll continue to monitor the macro market for shifts, but it can't stay on the sidelines for too long or 7-year-to-exit time frames will be pushed out and returns will fall, making it difficult to raise new funds. Once the dry powder is released, many of the trends laid out above will reverse.

Final Thoughts: We think there's a short time frame (6-8 months) where marketing conditions will be favorable from a price and inventory standpoint, with marketing budgets in the macro market pulling back slightly in 2023 and consumer spending and business spending remaining high.

Feel free to reach out with feedback or if you just want to chat about the market conditions or technology.

e: rob@bobsbookkeepers.com

e: matt@bobsbookkeepers.com

Thanks everyone,

Rob & Matt

Read more of our thoughts:

You can read January’s letter here – FRAME 1: WATCHING CYCLES REVERSE and last month’s newsletter here – FRAME 2: INDISTINGUISHABLE FROM MAGIC

Key takeaways from last month regarding ChatGPT's use cases were:

Outsourcing has never been easier. Look for ways to harness this new tech and cut your total costs. Language barriers are quickly becoming small hurdles.

You can use your current staff and this new automation to achieve growth without hiring more people.

In fact, this technology can boost a company's overall capacity and productivity by a great deal -- have your engineering team evaluate whether helpful code can be generated. It's worth considering how much more you can accomplish more with less HC by adopting this tech.

Embed ChatGPT into your marketing department. Let it generate content, then make some light edits or enhancements. It's much faster than paying Fiverr or another platform to do the same job.

Ask ChatGPT to recommend five "effective outbound sales subject lines" and use the one that you like the best -- anecdotally, we've seen high open and click rates when we send outbound email materials using this methodology

About Bob's Bookkeepers (or shameless plug):

Bob's Bookkeepers is a team of financial experts providing bookkeeping and strategic financial guidance for startups and later stage companies. We have a deep understanding that no startup's needs are the same. That is why we offer tailored services to navigate the complexities of sustaining and growing your company. We leverage our 20 years of working with startups to provide insights and guide founders. We use technology to assist companies in better managing their finances to sustain and grow. You can contact us here.

New?

If you're new to this content and want to subscribe, please use this link